SBA Loan Options

SBA Loan Options

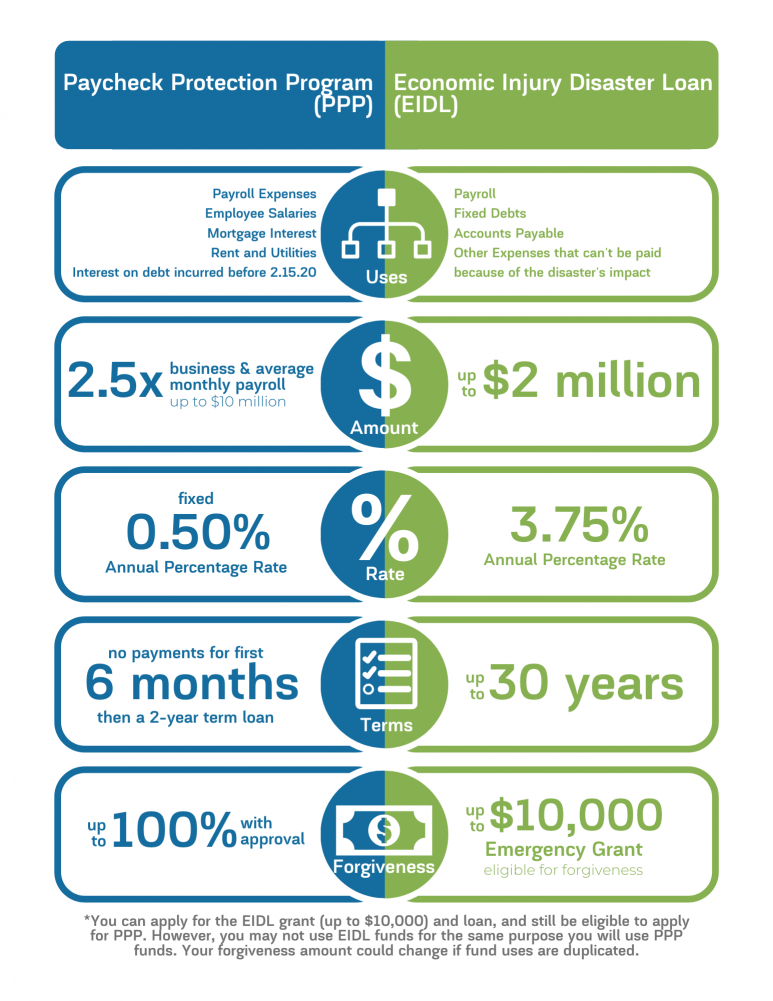

Legislation was passed recently that provides small businesses with the financial assistance they need through the SBA (Small Business Administration). There are two separate programs available: The Paycheck Protection Program (PPP) and Economic Injury Disaster Loan (EIDL).

The following comparison chart illustrates each program as we understand them right now.

U.S. Small Business Administration

PAYCHECK PROTECTION PROGRAM

The Coronavirus Aid, Relief and Economic Security (CARES) Act allocates $350 billion to help small businesses keep workers employed amid the pandemic and economic downturn.

Known as the Paycheck Protection Program (PPP), the initiative provides 100% federally guaranteed loans to small businesses. These loans may be forgiven if borrowers maintain their payrolls during the crisis or restore their payrolls afterward.

|

|

|

U.S. Small Business Administration

ECONOMIC INJURY DISASTER LOAN (EIDL)

We are working with the U.S. Small Business Administration (SBA) to offer low-interest federal disaster loans for working capital to small businesses suffering substantial economic injury as a result of the Coronavirus (COVID-19).

|

|

|

|

|

| SBA's Economic Injury Disaster Loans (EIDL) offer up to $2 million in assistance and can provide vital economic support to small businesses to help overcome the temporary loss of revenue they are experiencing. | These loans may be used to pay fixed debts, payroll, accounts payable and other bills that cannot be paid because fo the disaster's impact. The interest rate is 3.75% for small businesses. The interest rate for non-profits is 2.75%. | SBA offeres loans with long-term repayments in order to keep payments affordable up to a maximum of 30 years. Terms are determined on a case-by-case basis, based upon each borrower's ability to repay. |

Always putting people first.

We're in this together. If you have any questions regarding the options available to you for your business, please contact us and we will be in touch with you.