Who's Fault is Fraud?

Who's Fault is Fraud?

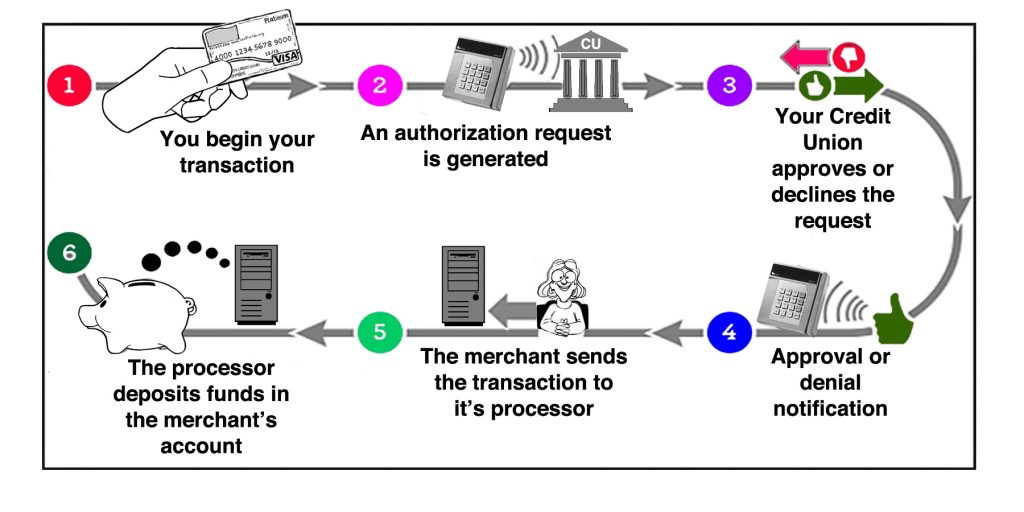

When you use your debit card, you can see interaction among three parties:

1. You tell a merchant you’d like to buy something.

2. That merchant tells your credit union to pay money from your account.

3. Your credit union asks you to authorize the transaction.

If something goes wrong in that process, you assume it’s the fault of one of these three parties. In the modern financial world, though, nothing is simple.

Here’s a look at three other places a financial transaction could go south and how to protect yourself.

1. The point-of-sale system

There are only a handful of companies that manufacture Point of Sale (POS) terminals — the systems that process credit and debit transactions. Having so few manufacturers means that anyone who learns how to defraud one of these terminals can do serious damage.

POS systems have other vulnerabilities, from PIN tracking keypads to miniature cameras. Always be watchful for small modifications in the keypads and other devices. If something looks suspicious, back out of a transaction or ask to use another register.

2. The merchant’s processor

Tiny margins are critical to most businesses, especially those that do many transactions. To keep costs low, these businesses use third-party payment-processors, which tally up the merchant’s transactions daily , bill the appropriate entity and pay the merchant. In exchange, they take a tiny percentage of each transaction.

There’s lots of competition in this niche, as companies continually offer lower prices to attract merchant business. Competition means companies cut costs to stay profitable – often by cutting corners with security.

Payment-processing companies can deal with millions of transactions daily. Not all companies use industry-standard data safeguards, representing another point in the chain where data security can be compromised and there exists a risk of fraud.

When shopping at unfamiliar places, be extra cautious by using a prepaid debit card, cash or another form of non-electronic payment. Don’t be afraid to use an ATM – they’re usually maintained by organizations with in-house processing, thus limiting the steps your data goes through. If you’re working with a merchant you trust, ask who does their payment processing. Most big credit card companies have preferred providers who follow the highest quality payment processing procedures.

3. Clearing houses

The last stage in this chain is the clearing house — external organizations that transfer funds, acting as the intermediary for the merchant’s payment-processor and the credit organization.

There’s a wide network of American Clearing House (ACH) payment centers. Most of them smoothly process millions of dollars worth of transactions every day. However, occasional mistakes happen and some transactions are processed improperly. Clearing houses are insured against losses and they quickly correct mistakes.

Every payment system has potential for fraud. A clerk can use phony bills, a check can be cashed multiple times, goods can be counterfeit and registers can overcharge. Electronic payment processing is among the most secure forms of exchange possible, and its failures are fixable. Swipe with confidence, knowing your liability is limited thanks to the strong trail of protection offered by electronic payment processing.